Posts Tagged ‘Brandi Nelson’

BNRE Team, Brandi Nelson, Century 21, Century 21 Signature, Iowa, real estate

In Uncategorized on September 7, 2016 at 7:00 pm

Word Press was nice enough to remind me last week that it has been over a year since I wrote a blog post. Ironically that last post was We Need You(r House)!! and we still do, but I’ll get to that later. First I want to apologize, I didn’t really mean to abandon you!

Let’s do a quick recap of 2016. Overall its been a great year for real estate in central Iowa. Personally I’m on track to have my best year yet. Sales are up, prices are holding steady, days on market are down but we are really short on listings.

There was a time early this summer in the Ames market when we were referring to “hours on market” and I overheard one agent in our office say… “I was a little disappointed, we only had 3 offers over asking price.” I think it is safe to say we’ve been spoiled. I’ve found myself saying to listing clients “We need to think about a price reduction, your property has been on the market a week with no offers…” It’s crazy. It’s different. It’s just a phase.

Like I said, personally I’m on track to have my best year yet and The Brandi Nelson Real Estate Team is on a roll! I’ve got two great “buyer agents” to back me up, Nicole Haberkorn and Karissa Elgersma who are doing a wonderful job. I’ve got them running all over central Iowa, writing offers, competing in multiple offer situations, and winning deals which allows me to focus on listings. David Whitaker, Whitaker Marketing Group has had some great auctions this year.

Now we’re already in September and people are talking about how much we will slow down. I don’t think we’ll slow down as much as usual. There are still a lot of buyers who haven’t found properties yet. The smart buyers will keep looking in Fall and into Winter, they’ll gobble (like my T-Day reference?) up properties that weren’t on the market during the crazy season. They’ll choose to move in less than ideal weather so that they can buy that perfect property. Sellers will realize that although there won’t be as many showings as a Spring/Summer listing, the showings will be better quality buyers.

That’s my quick synopsis. I don’t have a super clear agenda on where I’m taking this blog yet but I’ll cover hot topics that come up, go in depth on explaining common practices, discuss tools/marketing strategies and I’m always open to questions or ideas from you too!

Brandi Nelson, buying a home, Century 21, financing, mortgage, real estate, realtor, selling a home

In Uncategorized on May 8, 2014 at 4:40 pm

| A Great Reason to Sell Now

Posted: 08 May 2014 04:00 AM PDT

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases. The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale is still below the normal 6 month level of inventory. That means less competition.

However, a recent study revealed that 71% of current homeowners are considering selling their home this year. Putting your home on the market now instead of waiting for this increased competition to come to the market might make a lot of sense.

Buyers currently in the market are motivated purchasers. They want to buy now. With limited inventory available in most markets, a seller will be in a great position to negotiate their best possible price.

|

Brandi Nelson, buying a house, Century 21, financing, Iowa, mortgage, real estate, realtor, selling a house

In Uncategorized on April 23, 2014 at 1:29 pm

|

12,575 Houses Sold Yesterday!

Posted: 23 Apr 2014 04:00 AM PDT

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day. If you are considering whether or not to put your house up for sale, don’t let the headlines scare you. There are purchasers in the market and they are buying – to the tune of 12,575 homes a day. If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day. If you are considering whether or not to put your house up for sale, don’t let the headlines scare you. There are purchasers in the market and they are buying – to the tune of 12,575 homes a day.

|

Brandi Nelson, buying a home, Century 21, financing, Iowa, mortgage, real estate, realtor, selling a home

In Uncategorized on April 22, 2014 at 4:07 pm

|

With Rates & Prices on the Rise, Do You Know the True Cost of Waiting?

Posted: 22 Apr 2014 04:00 AM PDT

We, at KCM, have often broken down the opportunity that exists now for Millennials who are willing and able to purchase a home NOW… Here are a couple other ways to look at the cost of waiting. We, at KCM, have often broken down the opportunity that exists now for Millennials who are willing and able to purchase a home NOW… Here are a couple other ways to look at the cost of waiting.

Let’s say your 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle…You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

The difference in payment is $313.70 PER MONTH!

That’s like taking a $10 bill and tossing it out the window EVERY DAY!

Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (Average $2) with $12 left for lunch!

- There goes Friday Sushi Night! ($80 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $22,000 car for $313.00 per month.

Let’s look at that number annually! Over the course of your new mortgage at 5.7%, your annual additional cost would be $3,764.40!

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,764, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $112,932, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $112,932, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

|

Brandi Nelson, buying a home, Century 21, financing, Iowa, mortgage, real estate, realtor, selling a home

In Uncategorized on April 16, 2014 at 3:08 pm

|

Real Estate: We are NOT the Only Ones Saying You Should Buy

Posted: 16 Apr 2014 04:00 AM PDT

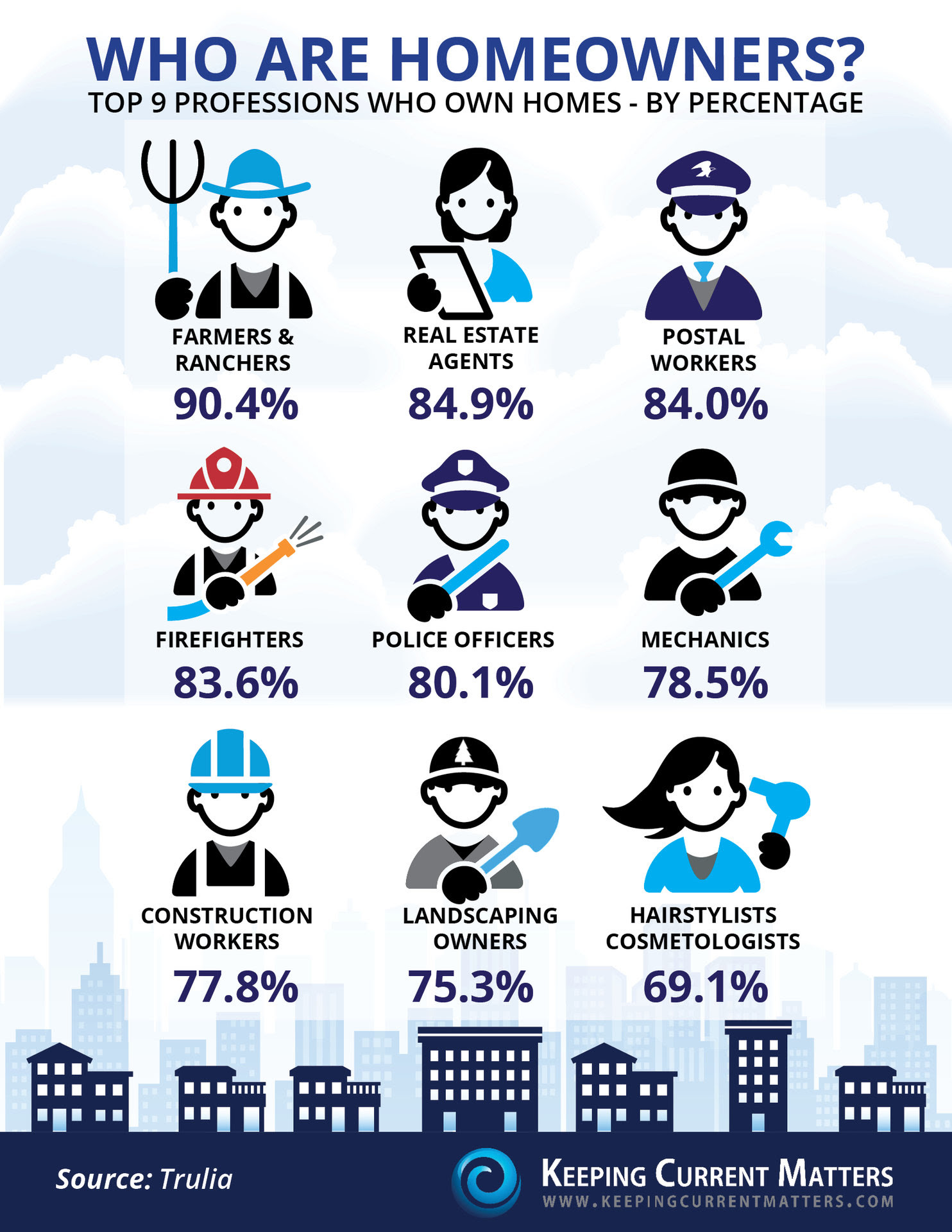

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family isready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy. We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family isready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

Benefits of Owning

Joint Center for Housing Studies, Harvard University

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord…Having to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings.”

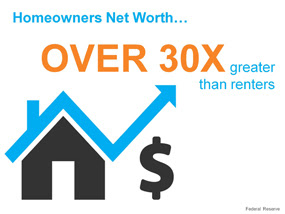

The Federal Reserve

“Renters have much lower median and mean net worth than homeowners in any survey year.”

Benefits of Buying Now

Trulia

“Buying costs less than renting in all 100 large U.S. metros… Now, at a 30-year fixed rate of 4.5%, buying is 38% cheaper than renting nationally.”

Freddie Mac

“One thing seems certain: we are not likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012…Yes, rates are higher than they were a year ago – and certainly higher than two years ago. But if you look at the averages over the last four decades, today’s rates remain historically low.”

|

Brandi Nelson, buying a home, Century 21, financing, Iowa, mortgage, real estate, real estate agent, realtor, selling a home

In Uncategorized on April 15, 2014 at 1:54 pm

|

Want to Sell Your House? Price it Right!

Posted: 14 Apr 2014 04:00 AM PDT

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about. The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

|

Brandi Nelson, buying a home, Century 21, financing, Homes for sale, housing, Iowa, real estate, realtor, renting, selling a home

In Uncategorized on April 10, 2014 at 3:28 pm

|

Homeownership’s Impact on Net Worth

Posted: 09 Apr 2014 04:00 AM PDT

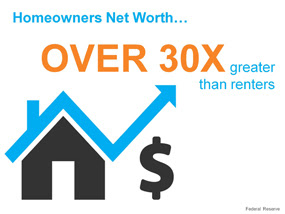

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question. Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

|

Brandi Nelson, buying a home, Century 21, financing, housing, Iowa, mortgage, real estate, real estate agent, realtor, selling a home

In Uncategorized on March 28, 2014 at 1:28 am

3 Reasons the Housing Market Should Thrive in 2014

Posted: 27 Mar 2014 04:00 AM PDT

Recently, HousingWire asked David Berson, chief economist at Nationwide, for his opinion on the near-term future of housing. Below are what Mr. Berson believes to be the three things you need to know about housing in 2014. We have included a quote from the article and a small comment from KCM for all three points.

Recently, HousingWire asked David Berson, chief economist at Nationwide, for his opinion on the near-term future of housing. Below are what Mr. Berson believes to be the three things you need to know about housing in 2014. We have included a quote from the article and a small comment from KCM for all three points.

Number 1: 2014 should prove to be the strongest year for housing activity since before the Great Recession

“Most economists expect an improved job market in 2014, with employment growth accelerating and the unemployment rate continuing to decline. That jobless rate drop will reflect more of a pickup in employment than further declines in the labor force participation rate. This will be the key factor improving housing demand this year, even if mortgage rates rise and affordability declines. While the housing market tends to do especially well when the job market improves and mortgage rates decline simultaneously, that combination of events occurs only rarely…People buy homes when their job and income prospects improve – even if it’s more expensive to do so – rather than buy when it is inexpensive to do so but they’re worried about keeping their jobs.”

KCM Comment:

We agree that the job market will continue to improve and that rising interest rates will not be a detriment to the market in 2014. As Doug Duncan, SVP and chief economist at Fannie Mae, recently revealed:

“Consumers have taken the interest rate rise in stride. Expectations for continued improvement in housing persist, and sentiment toward the current buying and selling environment is back on track.”

Number 2: Demographics should start to favor housing activity

“If the economy expands at a faster pace this year, bringing a more rapid rate of job creation, that should translate into more households, raising housing demand. We won’t see all three million missing households return to the housing market at once. (That wouldn’t be a good thing for the housing market anyway, since that would be on top of the 1.2 million households that normally would develop this year; such a surge would swamp the existing housing supply). Beginning in 2014, the pace of household formations should accelerate to an above-trend pace for several years, pushing up housing demand.”

KCM Comment:

The Urban Land Institute recently released a report, Emerging Trends in Real Estate 2014, projecting that 4.48 million new households will be formed over the next three years. Millennials will make up a large portion of these new households. With the economy improving, we believe they will finally be moving out of their parents’ homes and, after they compare renting versus buying, many will choose homeownership.

Number 3: Mortgage availability shouldn’t worsen and may improve

“The rise in mortgage rates already has reduced mortgage origination volumes as refinance activity declines. If mortgage rates rise further this year, as expected, then refinance activity will fall still more. In response, mortgage lenders probably will ease lending standards to the extent possible under the QM rules to boost lending activity by increasing purchase originations. As a result, the increase in new households expected to be created this year, spurred by a stronger job market, should find that qualifying for a mortgage loan will be somewhat easier in 2014 than in prior years.”

KCM Comment:

We also believe that, as the refinancing market begins to dry up, mortgage entities will be more aggressive in the purchase money market (mortgages necessary to purchase a home). There even seems to be recent evidence that lending standards are actually loosening.

Brandi Nelson, buying a home, Century 21, financing, mortgage, real estate, realtor, selling a home

In Uncategorized on March 17, 2014 at 1:42 pm

5 REASONS TO BUY A HOME NOW

Posted: 17 Mar 2014 04:00 AM PDT

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying.

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying.

1. Competition is about to Increase

Every spring a surge of prospective purchasers enter the housing market. Like you, they will want the best home available in the best location at the best price. They will be competing with you for the ‘steals’ in the market. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy available today that no longer be available as the market heats up..

2. Price Increases Are on the Horizon

Nationally, home prices are projected to appreciate by 4.5% in 2014 and by over 19% from now until 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.

3. Owning a Home Helps Create Family Wealth

Whether you rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Federal Reserve, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.

4. Interest Rates Are Projected to Rise

The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the spring of 2015. That is an increase of almost 3/4 of a point over current rates.

5. Buy Low, Sell High

Most would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.

Brandi Nelson, buying a home, Century 21, financing, Iowa, real estate, renting, selling a home

In Uncategorized on March 12, 2014 at 4:15 pm

|

Buying a Home Less Expensive than Renting – by 38%!

Posted: 12 Mar 2014 04:00 AM PDT

Trulia released their Rent vs. Buy Report last week. The report explained that homeownership remains cheaper than renting in all of the 100 largest metro areas by an average of 38%! Trulia released their Rent vs. Buy Report last week. The report explained that homeownership remains cheaper than renting in all of the 100 largest metro areas by an average of 38%!

The other interesting findings in the report include:

- Even though prices increased sharply in many markets over the past year, low mortgage rates have kept homeownership from becoming more expensive than renting.

- Some markets might tip in favor of renting this year as prices continue to rise faster than rents and if – as most economists expect – mortgage rates rise, due both to the strengthening economy and Fed tapering.

- Nationally, rates would have to rise to 10.6% for renting to be cheaper than buying – and rates haven’t been that high since 1989.

Buying a home now makes sense. You can lock in a mortgage payment before home prices and mortgage rates rise as experts expect they will. If you rent, your housing expense will only continue to increase.

|

Brandi Nelson, buying a home, Century 21, financing, home sales, Iowa, real estate, selling a home

In Uncategorized on March 11, 2014 at 5:11 pm

|

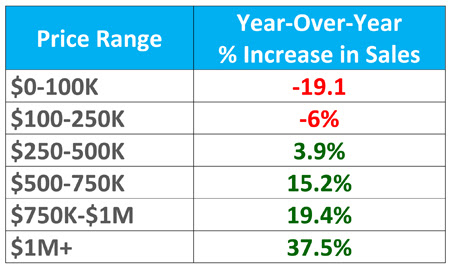

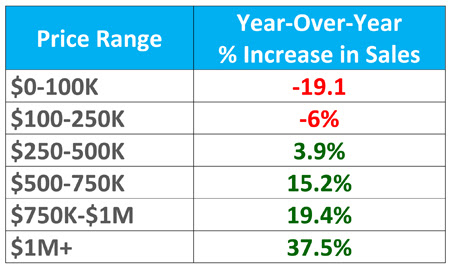

Home Sales: Are They Increasing or Decreasing?

Posted: 11 Mar 2014 04:00 AM PDT

There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data. There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data.

It is true that last month’s annualized sales rate of 4.62M was less than the 4.87M reported last January. However, after further scrutiny, the report reveals an interesting situation: sales of non-distressed properties are actually up. In January 2013, 23% of the 4.87M sales were distressed properties (foreclosures and short sales) meaning 3.75M non-distressed properties were sold. In January 2014, 15% of the 4.62M sales were distressed properties. That means 3.93M non-distressed properties sold – an increase of 180,000 sales.

When we dig deeper into NAR’s research, we also see that homes at the higher price points are selling at greater increases than the lower price points.

This deeper look at the report shows evidence that the housing market is still doing quite well when we removed distressed sales (which are in many cases lower end properties) from the equation.

|

Brandi Nelson, Century 21, financing, Iowa, mortgage, pricing your home, real estate, selling a house

In Uncategorized on March 6, 2014 at 2:24 pm

How to Price Real Estate

Posted: 06 Mar 2014 04:00 AM PST

Today we are excited to welcome back Ashley Garner as our guest writer today. Ashley has been a broker for over 20 years in the Wilmington, NC area. – The KCM Crew

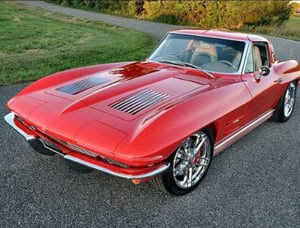

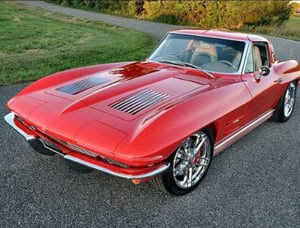

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price.

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price.

Think about it this way – you may really want to buy a car for your collection and your favorite happens to be a 1963 Corvette. So you hear about one for sale, in mint condition, across town but the only problem is the price, the owner is asking $150,000! Well, although you really, really want a mint condition 1963 Corvette, there is no way you will pay anywhere close to $150,000, in fact you know that the most a 1963 Corvette has ever sold for is about $200,000 and that was for a very rare model, which this one is not.

Because you are a bit obsessed with owning one of these cars you spend almost all of your free time, and some of the time you should be working, searching the internet for available cars. Through this exhaustive search you have become somewhat of an expert on the values of 1963 Corvettes, especially in your town. You happen to know that the particular model for sale across town is worth about $95,000…maybe $100,000. In fact, if the asking price was $100,000 or even $110,000 you would’ve driven over there today with your checkbook and driven home in a 1963 Corvette!

So why don’t you go make an offer? Well, let’s face it when you see a price that is so high compared to the actual value it makes you think that the seller is either difficult to deal with and is out of touch with reality or that he must not really want to sell the car, instead he is just fishing for the one fool in the world that will pay $150,000 for a car that is worth $95,000. So you don’t even go look at it or call for more information…you just keep searching the various websites to find the car of your dreams.

Yes, you guessed it the Corvette in this example actually represents your home or other real estate you might be trying to sell. (in fact it represents any item that can be bought and sold).

Wiggle room = Bad idea

Most sellers think that it is necessary to “leave a little wiggle room” in the price. They think this because they think that all buyers will make aggressively low offers…no matter what the asking price. WRONG!!

Buyers pay the fair market value …in other words they will pay you what it is worth! Your job is to find out what it is worth and price it at or near that value.

This is where brokers and/or appraisers come into the picture. The right way to price your property is to have a professional REALTOR/broker or appraiser prepare a CMA (Comparative Market Analysis) on your property. A CMA involves finding recent sales of similar properties, adjusting for any differences, to arrive at a current market value of your property. Once you have this value you should have your broker set the asking price no more than 3% to 5% higher than that current market value.

If you do this, your property will sell quickly for a price equal to exactly what it is worth, or higher! Buyers as a general rule DO NOT make “low-ball” offers, there are some rare occasions when that happens but the vast majority of initial offers are 5% or less below asking price.

If sellers price their property correctly the buyers will know it immediately because, just like in the Corvette example, buyers spend every spare moment searching the internet for a home, they have made themselves experts on the market value of the particular type of home in the particular area they desire. For this reason the buyer also knows when a property is overpriced. Most buyers will not even go look at a property that is overpriced, they say to themselves “why bother?” they assume that the seller is unreasonable and/or is not truly interested in selling the property.

Yesterday, the Buyer’s Specialist that works for my team and I were showing a house to some buyers who were very motivated had already decided on the neighborhood. The house was well within their price range and met every one of their criteria. As we stood in the kitchen discussing what price we should offer we found ourselves drawn to the fact that the house had been on and off of the market for the last four years!

The conversation immediately turned to “what is wrong with this house?” It turns out that the house hasn’t sold because it was severely overpriced most of that 4 years, it happens to be well priced now but the stigma it carries because of the lengthy time on the market will likely result in it selling for less than it is really worth.

Moral of this whole story is – buyers will pay what it is worth – Seller’s job is to find out what it is worth and set the asking price 3%-5% higher than that number…then sit and wait for the offers to roll in.

Brandi Nelson, buying a house, Century 21, financing, Iowa, mortgage, selling a house

In Uncategorized on March 4, 2014 at 4:17 pm

|

Should I Rent My House If I Can’t Sell It?

Posted: 04 Mar 2014 04:00 AM PST

A recent study has concluded that 39% of buyers prefer to rent out their last residence rather than sell it when purchasing their next home. A recent study has concluded that 39% of buyers prefer to rent out their last residence rather than sell it when purchasing their next home.

The study cites that many homeowners were able to refinance and “locked in a very low mortgage rate in recent years. That low rate, combined with a strong rental market, means they can charge more in rent than they pay in mortgage each month, so they are going for it.”

This logic makes sense in some cases. We at KCM believe strongly that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for. Are you ready to be a landlord?

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

10 Questions to Ask BEFORE Renting Your Home

1.) How will you respond if your tenant says they can’t afford to pay the rent this month because of more pressing obligations? (This happens most often during holiday season and back-to-school time when families with children have extra expenses).

2.) Because of the economy, many homeowners can no longer make their mortgage payment. What percent of tenants do you think can no longer afford to pay their rent?

3.) Have you interviewed a few experienced eviction attorneys in case a challenge does arise?

4.) Have you talked to your insurance company about a possible increase in premiums as liability is greater in a non-owner occupied home?

5.) Will you allow pets? Cats? Dogs? How big a dog?

6.) How will you actually collect the rent? By mail? In person?

7.) Repairs are part of being a landlord. Who will take tenant calls when necessary repairs arise?

8.) Do you have a list of craftspeople readily available to handle these repairs?

9.) How often will you do a physical inspection of the property?

10.) Will you alert your current neighbors that you are renting the house?

Bottom Line

Again, renting out residential real estate historically is a great investment. However, it is not without its challenges. Make sure you have decided to rent the house because you want to be an investor, not because you are hoping to get a few extra dollars by postponing a sale.

|

Brandi Nelson, buying a home, Century 21, Century 21 Signature, financing, Iowa, real estate, selling a home

In Uncategorized on February 26, 2014 at 2:10 pm

Just Believe Your Own Eyes

Posted: 26 Feb 2014 04:00 AM PST

Our founder, Steve Harney, occasionally asks to do a personal post on what he sees as important to our industry. Today is one of those days. Enjoy! – The KCM Crew

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes.

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes.

When my wife and I visited Miami ten years ago, we were amazed at the number of building cranes that lined the streets along the beachfront. There was a wave of buyers descending on the city with pockets full of money. Everywhere you looked, there was a new condo complex going up and each building being constructed required a crane on the property. Back then, the city of Miami looked like the set of a Transformer movie with what seemed like hundreds of these huge mechanical machines marching through the city.

Then the housing crisis hit.

Miami property values dropped by over 50%. The buying frenzy cooled.

The cranes disappeared.

Today, Miami’s house prices are beginning to rebound quite nicely. We purchased a condo in South Beach two years ago and have been happy to experience a nice bump in value already. However, this week we realized the Miami market is definitely back. Why do we know this?

The cranes are back.

From the balcony of our waterfront home we can look at the city skyline. This week we saw a familiar sight. Building cranes dotted that skyline. New buildings are being built. There is a new buzz in Miami. Things are the way we remember them being ten years ago.

It seems the market is back!

Brandi Nelson, buying a home, Century 21, Century 21 Signature, financing, Iowa, mortgage, real estate, realtor, selling a home

In Uncategorized on February 11, 2014 at 4:48 pm

|

Buying a Home: Should You Do it Now or Later?

Posted: 11 Feb 2014 04:00 AM PST

Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year. Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.

Interest rates have remained relatively stable since the onset of the tapering in December. This is probably because the first round of increases had already been ‘priced into’ the equation last summer when rates skyrocketed by over a full percentage point just on the speculation that tapering would take place later in 2013.

However, as we move forward, most analysts believe rates will start to rise culminating in a rate close to a full percentage point higher than current rates by this time next year. For example, Freddie Mac, Fannie Mae, The Mortgage Bankers’ Association and the National Association of Realtors have all recently projected rates to be between 5-5.4% at this time next year.

Bottom Line

If you are a first time buyer or a move-up buyer, the cost of the mortgage on your new home will probably increase as we move through the year. If the timing makes sense, buying sooner rather than later may save you a substantial amount of money over the long term in lower mortgage payments.

|

Brandi Nelson, buying a home, Century 21, Century 21 Signature, financing, Iowa, mortgage, real estate, Realtors, selling a home

In Uncategorized on February 10, 2014 at 3:18 pm

|

Be Quiet Chicken Little. The Sky is NOT Falling

Posted: 10 Feb 2014 04:00 AM PST

There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions. There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

MORTGAGE INTEREST RATES

ASSUMPTION: Rising interest rates have forced buyers back onto the fence. Evidence offered up by those in this camp comes directly from the EHS Report from NAR. Three of the last four reports revealed that sales were below sales from the same month the previous year.

THE REALITY: Though it is true year-over-year sales have fallen nationally, a closer look at the report reveals major regional differences. Sales in the West Region are down 10.7% versus the same month last year. Sales in the Midwest Region are also down but by less than 1%. The Northeast Region is up 3.2% and the Southern Region is up 4.6%.

If the issue is interest rates, why is one region virtually unchanged and two of the remaining three regions up in sales? We don’t believe rates are the challenge.

CONSUMER CONFIDENCE in REAL ESTATE is ERODING

ASSUMPTION: The pace of the recent price increases has caused many to fear the emergence of a new housing bubble. Similar to the first assumption, evidence offered up by those in this camp comes directly from the less than enthusiastic EHS Reports from NAR.

THE REALITY: As we mentioned before, sales in the Midwest Region are down but by less than 1%. The Northeast and the Southern Region have both shown increased sales as compared to the year before. Are only the consumers in the Western Region afraid of a possible bubble forming?

The fear of a new housing bubble is vastly overstated. Forty states have not yet returned to home values they experienced seven to nine years ago. Nineteen of those forty states still have home prices 15% or more below peak prices. We believe home values will continue to increase but just at a slower rate of appreciation.

It is not just us that believe this is the case. The over 100 housing experts recently surveyed by Pulsenomics revealed that they believe prices will continue to appreciate at historical annual numbers (3-4%) for at least the next five years.

THEN WHAT IS THE CHALLENGE?

If the lack of sales is not the result of increasing interest rates or decreasing consumer confidence, what actually is happening? We believe it can be broken down to three words: LACK of INVENTORY.

Inventories of foreclosure and short sale properties are falling like a rock in the vast majority of regions across the nation. These two categories of homes have driven the market for the last few years. As foreclosures and short sales sell, they are not being replaced because the economy has gotten better and more families have regained control of their finances. All fifty states have seen a decrease in the number of homeowners who are seriously delinquent on their mortgage payments with thirty nine states seeing the number shrink by over 20%.

This inventory has not yet begun to be replaced by the non-distressed properties in the country. Just this month, NAR revealed that the months’ inventory of homes for sale has dropped to only a 4 month supply. A normal market has between 5-6 months’ supply.

This is the main reason home sales are declining in certain regions – there are just not enough houses for sale.

BOTTOM LINE

With the economy improving and with homeowners gaining back some equity they lost when prices fell, we believe there will be many homes coming unto the market this spring. A recent survey revealed that 71% of homeowners are at least considering selling their home in 2014.

If you are thinking of selling, beating this increased competition to the market before spring might make sense – and might enable you to get the best price possible for your home.

|

Brandi Nelson, Century 21, Century 21 Signature, financing, home buying, home selling, Iowa, mortgage, real estate, VA loan

In Uncategorized on February 6, 2014 at 3:43 pm

|

5 Things You Probably Don’t Know About VA Loans

Posted: 06 Feb 2014 04:00 AM PST

We are pleased to welcome Phil Georgiades as our guest blogger today. Phil is the Chief Loan Steward for VA Home Loan Centers, a veteran and active duty military services organization. – The KCM Crew

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it. VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

With this in mind, we would like to debunk the most common myths about VA Loans.

Myth 1: The VA loan benefit has a “one time” use.

Fact: Veterans and active duty military can use the VA loan many times. There is a limit to the borrower’s entitlement. The entitlement is the amount of loan the VA will guarantee. If the borrower exceeds their entitlement, they may have to make a down payment. Never the less, there are no limitations on how many times a Veteran or Active Duty Service Member can get a VA loan.

Myth 2: VA home loan benefits expire if they are not used.

Fact: For eligible participants, VA mortgage benefits never expire. This myth stems from confusion over the veteran benefit for education. Typically, the Montgomery GI Bill benefits expire 10 years after discharge.

Myth 3: A borrower can only have one VA loan at a time.

Fact: You can have two (or more) VA loans out at the same time as long as you have not exceeded your maximum entitlement and eligibility. In order to have more than one VA loan, the borrower must be able to afford both payments and sufficient entitlement is required. If the borrower exceeds their entitlement, they may be required to make a down payment.

Myth 4: If you have a VA loan, you cannot lease the home.

Fact: By law, homeowners with VA loans may rent out their home. If the home is located in a non-rental subdivision, the VA will not guarantee the loan. If the home is located in a subdivision (such as a co-op) where the other owners can deny or approve a tenant, the VA will not approve the financing. When an individual applies for a VA loan, they certify that they intend on making the home their primary residence. Borrowers cannot use their VA benefits to buy property for rental purposes except if they are using their benefits to buy a duplex, triplex or fourplex. Under these circumstances, the borrower must certify that they will occupy one of the units.

Myth 5: If a borrower has a short sale or foreclosure on a VA loan, they cannot have another VA loan.

Fact: If a borrower has a claim on their entitlement, they will still be able to get another VA loan, but the maximum amount they would otherwise qualify for may be less. For example, Mr. Smith had a home with a $100,000 VA loan that foreclosed in 2012. If Mr. Smith buys a home in a low cost area, he will have enough remaining eligibility for a $317,000 purchase with $0 money down. If he did not have the foreclosure, he would have been able to obtain another VA loan up to $417,000 with no money down payment.

Veterans and Active duty military deserve affordable home ownership. In recent years, the VA loan made up roughly 13% of all home purchase financing. This program remains underused largely because of misinformation. By separating facts from myth, more of America’s military would be able to realize their own American Dream.

|

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases. If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell  We, at KCM, have often broken down the opportunity that exists now for Millennials who are willing and able to purchase a home NOW… Here are a couple other ways to look at the cost of waiting.

We, at KCM, have often broken down the opportunity that exists now for Millennials who are willing and able to purchase a home NOW… Here are a couple other ways to look at the cost of waiting. We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family isready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family isready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy. The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about. Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A  Recently, HousingWire asked David Berson, chief economist at Nationwide, for

Recently, HousingWire asked David Berson, chief economist at Nationwide, for

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying.

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying. Trulia released their

Trulia released their  There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data.

There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data.

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price.

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price. A

A

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes.

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes. Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.

Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year. There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.